When it comes to caring for our cherished pets, ensuring their health and well-being is a top priority. However, with rising veterinary costs and unpredictable health issues, pet insurance has become an essential safety net for many pet owners. If you’re like me, seeking the best pet insurance plan for your furry friend can feel overwhelming—there are so many options, coverage nuances, and fine print to consider. Fear not! In this comprehensive guide, I’ll walk you through everything you need to know—from understanding pet insurance basics to detailed reviews of the top 7 plans on the market today.

Whether you have a playful puppy, a curious kitten, or a seasoned senior companion, this article covers it all. You’ll discover how to choose the best coverage tailored to your needs, what to watch out for in policies, and how to leverage wellness add-ons for preventive care. Plus, we’ll dive into handy tips for filing claims, managing policies via mobile apps, and even alternative financial strategies for pet health. Let’s embark on this journey to safeguard your beloved pet’s health with confidence!

Understanding Pet Insurance: Why It Matters for Your Pet’s Health

The Rising Costs of Veterinary Care

Veterinary care has evolved immensely, with advanced diagnostics, surgical procedures, and specialist treatments becoming more accessible—but not necessarily affordable. According to the American Pet Products Association, the average annual cost for pet healthcare is steadily climbing, with emergency visits often costing $1,000 or more per incident. This growing financial burden highlights the importance of best pet insurance plans for dogs and cats that can help manage unexpected vet bills without compromising on your pet’s care.

From routine checkups and vaccinations to emergency surgeries and chronic condition management, pet insurance helps pet owners avoid those tough decisions influenced by cost. Investing in a comprehensive insurance plan can bring peace of mind, knowing that your pet’s medical needs won’t break the bank.

Types of Pet Insurance Plans Explained

Before diving into specific companies, it helps to understand the different types of pet insurance available:

- Accident-Only Coverage: Covers injuries from accidents like broken bones or poisonings but excludes illnesses. Affordable but limited.

- Accident and Illness Coverage: Covers both accidents and illnesses, including cancer, infections, and most hereditary conditions.

- Wellness or Preventive Care Plans: Often offered as add-ons, these cover routine care like vaccinations, flea prevention, dental cleanings, and annual exams.

- Comprehensive Coverage: Combines accident, illness, hereditary condition, and wellness care, providing the broadest protection.

Knowing which plan suits your pet’s lifestyle and health risks helps narrow down the best pet insurance policy choices.

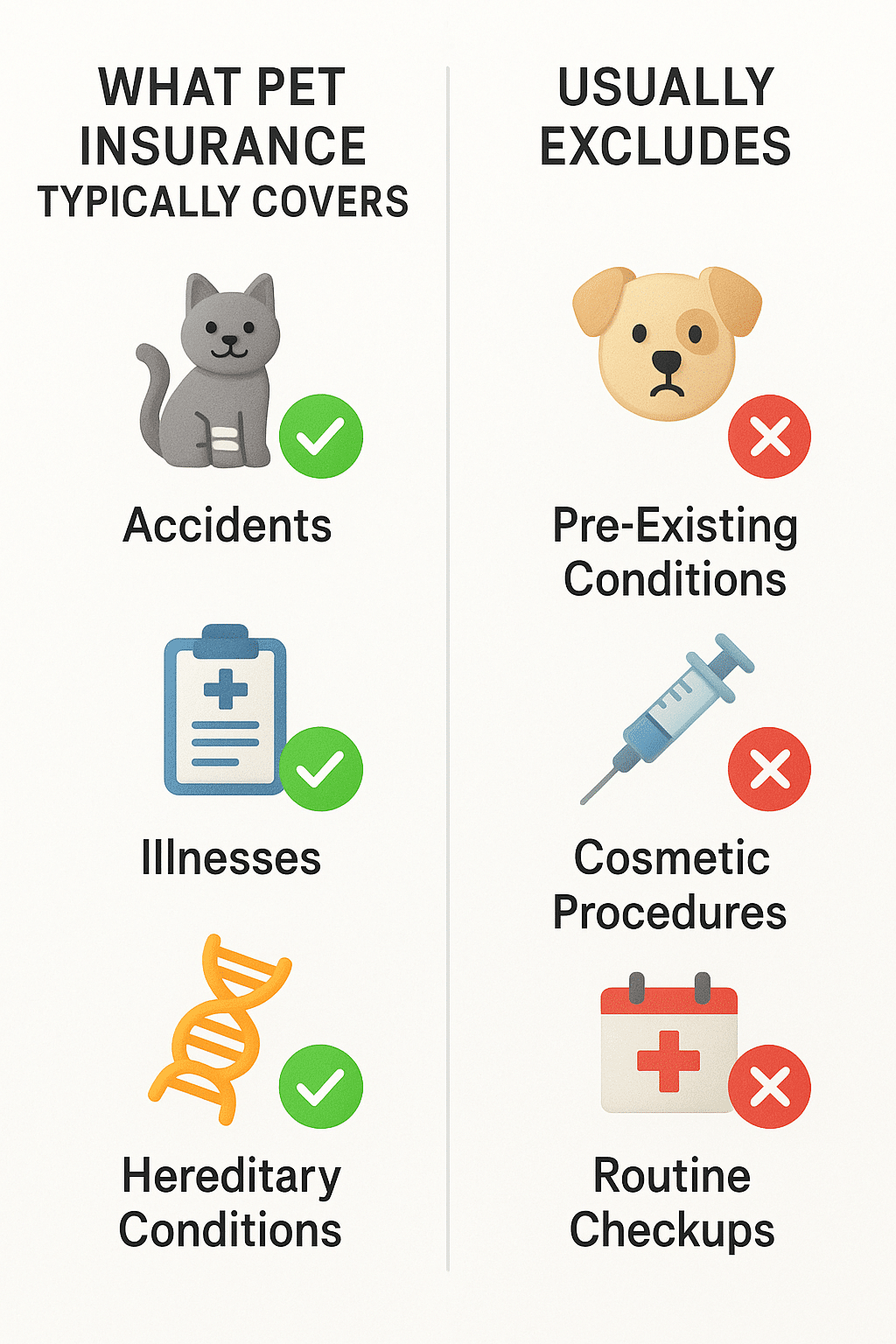

Key Coverage Areas: Accidents, Illness, Wellness, and More

The best pet insurance plans typically cover these key areas:

- Accidents: Injuries, cuts, broken bones, ingestion of toxins.

- Illnesses: Infections, cancer, chronic diseases, hereditary and congenital conditions.

- Wellness Care: Vaccinations, flea and tick control, routine blood work, annual exams.

- Alternative Medicine: Some policies cover acupuncture, chiropractic care, and physical therapy.

- Emergency and Specialist Care: Surgery, imaging (X-rays, MRI), and specialist vet visits.

It’s crucial to read policy details carefully to understand exactly what is included or excluded—more on that later.

How to Choose the Best Pet Insurance Policy for Your Needs

Factors Influencing Pet Insurance Rates

Several factors influence your pet insurance premiums:

- Pet’s Age: Younger pets generally cost less to insure; older pets face higher premiums.

- Breed and Species: Certain breeds may be prone to hereditary issues, affecting rates.

- Location: Veterinary costs vary widely by region; urban areas may have higher premiums.

- Coverage Level: Higher reimbursement percentages and lower deductibles raise premiums.

- Policy Type: Accident-only plans are cheaper than comprehensive coverage.

Understanding these factors helps you set realistic expectations on pricing when comparing policies like MetLife, Lemonade, or AKC Pet Insurance.

Coverage Limits, Deductibles, and Reimbursement Options

When evaluating plans, consider these key terms:

- Annual or Lifetime Coverage Limits: The maximum amount the insurer will pay per year or over your pet’s lifetime.

- Deductible: The amount you pay out-of-pocket before insurance kicks in; can be annual or per-incident.

- Reimbursement Level: The percentage of covered costs the insurer will reimburse, commonly 70%, 80%, or 90%.

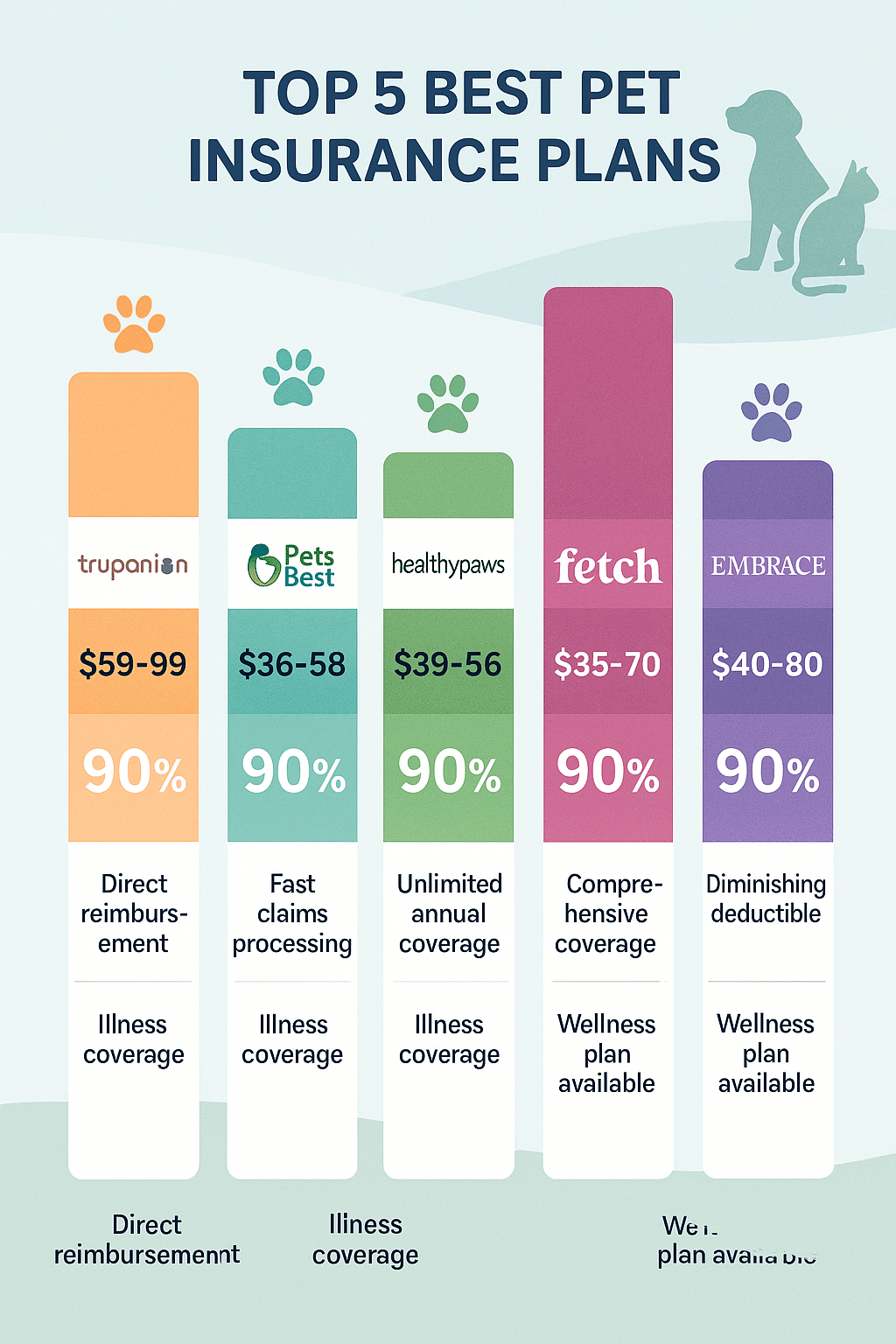

For example, Pets Best Pet Insurance offers flexible deductible options ranging from $100 to $1,000 and reimbursement levels from 70% to 90%, allowing customization to your budget.

Choosing the right balance between deductible and reimbursement can lower your monthly premium while ensuring adequate coverage.

Decoding Exclusions: What Pet Insurance Typically Doesn’t Cover

Almost every pet insurance policy has exclusions, so it’s important not to be caught off guard. Common exclusions include:

- Pre-Existing Conditions: Illnesses or injuries your pet had before coverage begins.

- Elective Procedures: Cosmetic surgeries or non-essential treatments.

- Pregnancy and Breeding: Unless explicitly covered.

- Behavioral Issues: Most plans don’t cover behavioral therapy.

- Preventive Care: Unless you add a wellness plan.

For instance, AKC Pet Insurance offers coverage for pre-existing conditions after 365 days of continuous coverage, a rare benefit worth considering.

Comprehensive Reviews of the 7 Best Pet Insurance Providers

1. MetLife Pet Insurance: Robust Coverage and Innovative Mobile Tools

Coverage Highlights and Customer Benefits

MetLife Pet Insurance stands out for its comprehensive plans that reimburse up to 90% of vet bills covering accidents, illnesses, emergencies, and routine wellness visits. It supports dogs, cats, and even birds, with customizable plans tailored to your pet’s needs.

One standout feature is the variety of discounts available for enrolling online or through your employer, helping pet owners save money without sacrificing coverage.

Managing Your Policy with the MetLife Pet App

Their highly rated mobile app (iOS) lets you submit claims instantly, track reimbursements, and access 24/7 telehealth consultations with licensed veterinarians. This digital approach simplifies pet healthcare management and puts expert advice at your fingertips anytime — invaluable for busy pet owners.

To explore MetLife Pet Insurance plans, get a free quote, or learn about discounts, visit metlifepetinsurance.com.

2. Lemonade Pet Insurance: Affordable Plans with Fast Claims Processing

Wellness and Preventive Care Add-Ons

Lemonade offers comprehensive coverage for accidents and illnesses, plus optional add-ons for wellness care like annual exams, vaccinations, and dental cleanings. Their modern interface and quick claims processing—with roughly 40% reimbursed instantly—make managing your pet’s health hassle-free.

Premiums vary by pet age, location, and breed, with monthly costs ranging from $35 to $49 in California cities for example.

State Availability and User Experience

Available in 41 states and Washington, D.C., Lemonade is great for pet owners in most regions but unavailable in select states like Alaska or Kentucky. While many users praise the affordability and claims speed, some report customer service hiccups—always a good reason to read the fine print.

Visit lemonade.com/pet for details and quotes.

3. Rainwalk Pet Insurance: Hassle-Free Reimbursements and Virtual Vet Access

Unique Features and Customer Support

Rainwalk distinguishes itself with free virtual vet visits included in all plans—a valuable service for quick health concerns. Reimbursements process swiftly, typically within days via Venmo or ACH direct deposit, giving you fast financial relief.

Unlike policies restricting you to certain vets, Rainwalk lets you choose any licensed veterinarian nationwide, and coverage lasts your pet’s entire life.

Customer support is accessible via phone or email and highly responsive.

Learn more at rainwalkpetinsurance.com.

4. AKC Pet Insurance: Best for Pre-Existing Conditions and Community Support

Flexible Plans and the Pet Cloud App

The American Kennel Club’s pet insurance offers flexible plans covering accidents, illnesses, and wellness care. What sets it apart is coverage for pre-existing conditions after 365 days, which is almost unheard of industry-wide.

Their free Pet Cloud app keeps your pet’s medical records organized, offers reminders, and connects you to a community of pet lovers. The included 24/7 Vet Helpline provides expert advice whenever needed.

Premiums range from $5 to $50 monthly, depending on pet age and coverage, with higher deductibles lowering costs.

Check out akcpetinsurance.com for quotes and details.

5. Pets Best Pet Insurance: Customizable Plans With No Upper Age Limits

Routine Care Add-Ons and Claim Submission Ease

Pets Best offers versatile plans covering accidents, illnesses, hereditary conditions, and optional routine care such as vaccinations and dental cleanings. They allow you to select deductibles from $100 to $1,000, reimbursement levels of 70-90%, and annual coverage caps, including unlimited options.

The absence of an upper age limit means your senior pet isn’t left out.

The mobile app simplifies claim submissions and tracks reimbursements with efficiency, plus 24/7 helpline access offers peace of mind any time.

For more information, visit petsbest.com.

6. Pumpkin Pet Insurance: Quick Reimbursements and Preventive Care Options

The PumpkinNow™ Urgent Pay Service

Pumpkin’s standout feature is its PumpkinNow™ service, reimbursing up to 90% of eligible expenses within just 15 minutes. This urgent pay service is a game-changer, enabling you to settle vet bills before even leaving the clinic—a huge relief in emergencies.

Their plans cover accidents, illnesses, and wellness care, with no age or breed restrictions. Optional wellness packages include vaccines and annual exams for comprehensive preventive care.

Pumpkin is available nationwide, loved for fast claims processing and friendly service.

Visit pumpkin.care to learn more.

7. Spot Pet Insurance: Multi-Pet Discounts and 24/7 Telehealth Helpline

Mobile App Features and AAA Member Benefits

Spot Pet Insurance offers up to 90% cashback on vet bills with the freedom to visit any licensed vet. Their 24/7 pet telehealth helpline is a valuable resource for immediate advice.

The Spot mobile app manages claims, policy updates, and helpline access conveniently on your phone. AAA members enjoy up to 20% off, including multi-pet discounts, making Spot a superb choice for families with multiple furry companions.

Explore options or get a quote at spotpet.com.

Comparing Best Pet Insurance Plans: Side-by-Side Features and Pricing

| Provider | Coverage Types | Reimbursement | Deductible | Multi-Pet Discount | Wellness Add-On | Mobile App | Telehealth |

|---|---|---|---|---|---|---|---|

| MetLife | Accident, Illness, Wellness | Up to 90% | Varies | Yes | Yes | Yes | 24/7 Vet Chat |

| Lemonade | Accident, Illness, Optional Wellness | 70-90% | Varies | Limited | Yes | Yes | No |

| Rainwalk | Accident, Illness, Routine Vaccinations | Varies | Flexible | Yes | No | No | Free Virtual Vets |

| AKC | Accident, Illness, Wellness | 70%-90% | Varies | Yes | Yes | Yes | 24/7 Vet Helpline |

| Pets Best | Accident, Illness, Hereditary, Wellness | 70%-90% | $100-$1,000 | Yes | Yes | Yes | 24/7 Helpline |

| Pumpkin | Accident, Illness, Wellness | Up to 90% | Varies | Unknown | Yes | No | No |

| Spot | Accident, Illness, Wellness | Up to 90% | Varies | Yes (AAA Only) | Yes | Yes | 24/7 Telehealth |

Pricing and Discounts for Multi-Pet Owners

If you have more than one pet, multi-pet discounts can save a significant amount. Both MetLife, Pets Best, and Spot offer multi-pet discounts, with Spot giving up to 20% off for AAA members covering multiple pets on the same policy.

Always inquire about discounts when getting quotes, especially if you insure multiple dogs or cats.

Claims Processing and Customer Support Ratings

Quick and hassle-free claims are a hallmark of a great insurance experience. Lemonade impresses with instant reimbursements for many claims, while Pumpkin’s urgent pay service speeds up payments dramatically. Customer service reviews indicate MetLife and Pets Best receive high marks for responsiveness, while some users find Lemonade’s customer service less consistent.

Mobile apps from MetLife, Pets Best, and Spot enhance user experience by enabling easy claims filing and policy management on the go.

Wellness and Preventive Care Plans: Enhancing Your Pet’s Long-Term Health

What Wellness Plans Cover and Why They Matter

Wellness add-ons usually cover routine care like vaccinations, flea and tick prevention, dental cleanings, and annual exams. Although these don’t cover emergencies, they help maintain your pet’s health and may prevent costly treatments down the road.

For instance, pets with regular checkups and vaccinations through wellness plans provided by MetLife, Lemonade, or Pets Best tend to catch health issues early.

Integrating Wellness Plans with Your Pet Insurance Policy

It’s smart to bundle wellness care with a traditional insurance plan. Some companies allow customization so you can add just the wellness coverage your pet needs, avoiding paying for unnecessary extras.

For example, Pets Best and Pumpkin offer optional wellness coverage which can be tailored to your pet’s lifestyle, maximizing value.

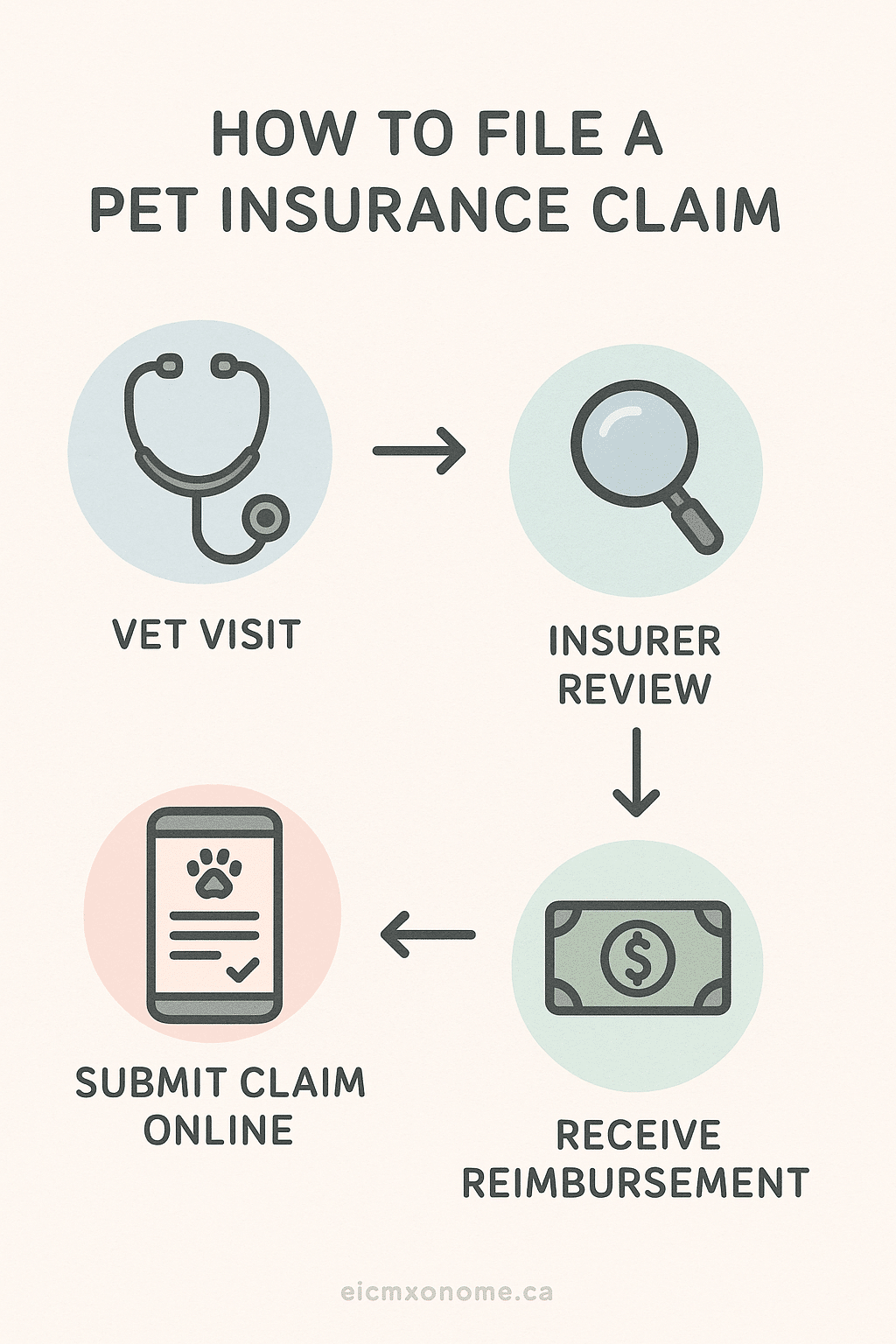

Navigating Pet Insurance Claims: Tips for Maximizing Reimbursements

Efficient Claims Submission Processes

Submitting claims digitally via mobile apps or online portals speeds up processing and reimbursement. Most of the providers reviewed offer apps with clear claim submission workflows.

Always keep copies of vet bills, medical records, and prescriptions handy to avoid delays.

Common Claim Denial Reasons and How to Avoid Them

Frequent reasons for denial include:

- Claims submitted for pre-existing conditions.

- Missing or incomplete documentation.

- Services excluded by your policy.

- Claims filed after the deadline.

Reading your policy thoroughly and staying organized can prevent many headaches.

Leveraging Mobile Apps for Easy Claims and Policy Management

Apps from MetLife, Pets Best, Spot, and Lemonade enhance your ability to submit claims on the spot, view payment statuses, and communicate with insurers quickly.

If you want a seamless experience, choose a provider with a strong mobile presence.

Beyond Insurance: Alternative Strategies for Pet Health Financial Planning

Pet Savings Accounts vs. Pet Insurance

Some pet owners opt to save funds monthly in a pet-specific savings account to cover future vet expenses instead of buying insurance. While this can work for minor needs, insurance provides protection against catastrophic costs—often saving thousands.

Bundling Insurance with Other Pet Services for Savings

Certain companies, like Spot and MetLife, offer discounts when bundled with other pet-related products or services, which can be cost-effective.

Planning for Hereditary and Chronic Conditions

If your pet’s breed is prone to hereditary issues, selecting plans like AKC or Pets Best, which cover hereditary conditions extensively, is vital. Long-term planning can minimize surprise expenses related to chronic illnesses.

Local Resources and Support for Pet Owners

Finding Quality Veterinarians Near You

Begin by researching local vets with strong reputations, reviews, and specialties that match your pet’s needs. Online directories and word-of-mouth are invaluable.

Accessing Telehealth and Emergency Pet Care Services

Many insurance providers now offer telehealth vet consultations 24/7—great for urgent questions and minor issues. Emergency clinics should also be mapped out in advance for peace of mind.

Community Groups and Online Forums for Pet Care Advice

Engaging with local or online communities, such as breed-specific forums or city pet groups, provides advice, support, and recommendations on pet insurance and care.

Frequently Asked Questions About Best Pet Insurance

Can I Get Coverage for Pre-Existing Conditions?

Most pet insurance policies exclude pre-existing conditions. However, AKC Pet Insurance stands out by covering both curable and incurable pre-existing conditions after 365 days of continuous coverage.

How Early Should I Insure My Pet?

The earlier, the better! Insuring your puppy or kitten soon after adoption ensures coverage for any future illnesses or accidents and prevents pre-existing condition exclusions.

Are Alternative Therapies Covered?

Coverage for alternative medicine (such as acupuncture or physical therapy) varies by provider. Some companies, like AKC or Pets Best, offer optional coverage for these treatments.

Is Pet Insurance Worth the Cost?

Absolutely—especially considering the high cost of emergency care. Insurance can save you thousands and assure your pet receives the best treatment without financial stress.

How Do Reimbursement Rates Work in Pet Insurance?

You pay your vet bill upfront and then submit a claim. The insurer reimburses a set percentage (e.g., 80% or 90%) of the covered amount, minus your deductible. Choosing a higher reimbursement means higher premiums but less out-of-pocket.

Quick Takeaways/Key Points

- Veterinary care costs are rising, making the best pet insurance plans critical to manage expenses.

- Understand different plan types: accident-only, accident-illness, wellness add-ons, and comprehensive coverage.

- Review policy limits, deductibles, reimbursement rates, and exclusions carefully.

- MetLife, Lemonade, Rainwalk, AKC, Pets Best, Pumpkin, and Spot are top providers with unique features.

- Wellness plans enhance long-term health by covering preventive care.

- Use mobile apps for managing policies and quick claims submission.

- Pre-existing condition coverage options are limited but available with AKC after one year.

- Multi-pet owners benefit from discounts with several providers.

- Alternative financial planning includes savings accounts and bundled services.

- Local veterinary and telehealth resources complement insurance for optimal pet care.

Final Thoughts: Protecting Your Pet’s Health with the Best Pet Insurance

Choosing the best pet insurance is one of the most proactive steps you can take as a responsible pet owner. It’s about more than just mitigating costs—it’s about guaranteeing that your furry friend gets the care they deserve, no matter what the future holds. By understanding policy options, coverage details, and leveraging technology like mobile apps and telehealth, you can make an informed decision tailored to your pet’s unique needs.

Personally, I find that comprehensive coverage paired with wellness add-ons offers the best balance of protection and preventive care, helping to avoid costly emergencies while keeping routine health on track. Whether you have a lively puppy or a wise senior cat, the peace of mind from having quality insurance truly makes all the difference.

I invite you to explore the plans reviewed here, gather quotes, and ask questions to find the perfect fit for your furry family member. After all, their health is priceless—and the right pet insurance is your best ally in protecting it.