As a pet owner, I understand how heartwarming yet challenging it can be to ensure your furry friends get the best veterinary care without breaking the bank. This is where affordable pet insurance becomes a game-changer — it helps manage unexpected medical expenses, promotes timely vet visits, and provides peace of mind. However, with so many insurance plans and providers out there, finding one that strikes the perfect balance between coverage and cost can feel like navigating a maze.

In this comprehensive guide, I’ll walk you through the essentials of affordable pet insurance, factors influencing premiums, standout providers worth considering, and smart strategies to save money without compromising your pet’s health. Whether you have a playful puppy, a wise senior cat, or a rescue animal, this article offers practical insights and trusted advice to help you make informed decisions tailored to your pet’s needs and your budget.

Understanding Affordable Pet Insurance: Basics Every Pet Owner Should Know

What Does Affordable Pet Insurance Typically Cover?

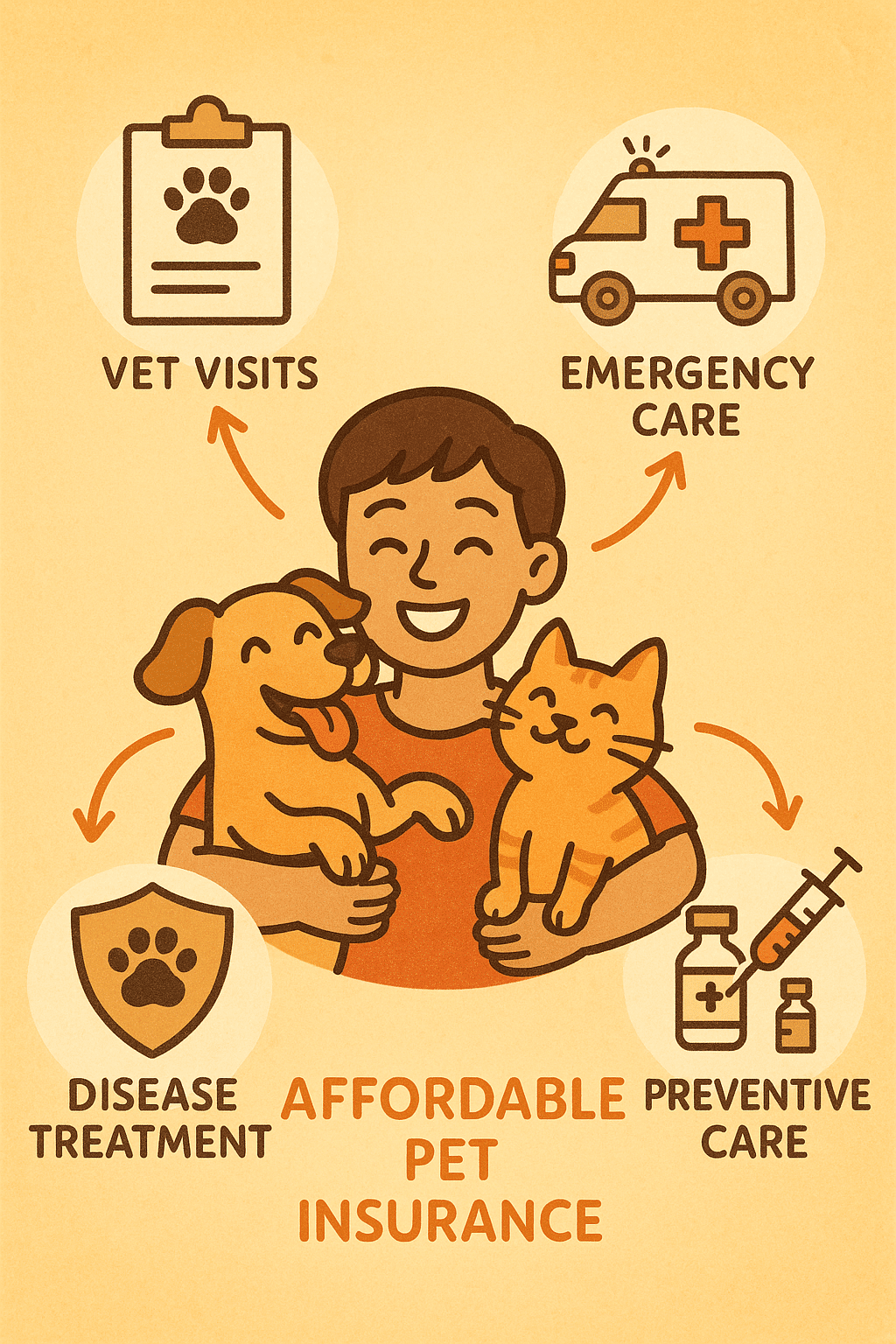

When seeking affordable pet insurance, it’s essential to know what the policy typically covers. Most plans focus on accident and illness coverage, protecting against unexpected veterinary expenses like broken bones, allergic reactions, infections, and chronic diseases such as diabetes or arthritis. Many insurers also offer hereditary and congenital condition coverage, which matters a lot if your pet belongs to a breed prone to genetic health problems.

For example, Pets Best Pet Insurance’s customizable plans cover accidents, illnesses, emergency care, prescription medications, dental diseases, and even hereditary conditions — all crucial for comprehensive protection. (petsbest.com)

Besides these core benefits, some providers offer optional routine care packages addressing preventive healthcare such as vaccinations, spaying/neutering, dental cleanings, wellness exams, and parasite control. This is especially useful for budget-conscious pet owners who want to manage day-to-day health costs. Chewy’s CarePlus Wellness Plans are a prime example, helping cover regular vet visits alongside typical insurance coverage for accidents and illnesses. (chewy.com/pet-insurance)

Common Exclusions and How They Impact Costs

It’s crucial to understand that no matter how affordable a plan seems, there are likely exclusions and limits that affect its overall coverage and cost. Pre-existing conditions—any illness or injury your pet had before insurance enrollment—are typically excluded. However, some providers like Figo Pet Insurance may cover curable pre-existing conditions if they have been symptom-free for a set period, offering more flexibility. (figopetinsurance.com)

Other common exclusions include cosmetic and elective procedures, breeding-related care, and behavioral treatments beyond basic coverage. Also, certain illnesses categorized as chronic or hereditary might have waiting periods before becoming eligible for claims, which can influence when you actually benefit from your policy.

Understanding these exclusions upfront can prevent surprises and guide you toward plans that truly match your pet’s health profile and your financial tolerance.

Factors Influencing the Cost of Affordable Pet Insurance

Pet Age, Breed, and Location Impacts on Premiums

When it comes to affordable pet insurance premiums, several factors come into play, and knowing these will help you anticipate costs and choose wisely.

-

Age: Younger pets usually get lower rates because they’re less likely to need costly treatments. Enrolling your puppy or kitten early, before any health issues arise, can lock in affordable premiums. However, some insurers like Prudent Pet Insurance do not have upper age limits and welcome senior pets with competitive pricing. (prudentpet.com)

-

Breed: Certain breeds are predisposed to illnesses that increase veterinary costs — think Bulldogs with respiratory issues or certain large breeds prone to hip dysplasia. Some plans might charge higher premiums or have breed-specific restrictions, but providers like Pets Best and Prudent Pet offer breed-inclusive policies without restrictions, helping owners of all breeds find affordable options. (petsbest.com)

-

Location: Veterinary care costs vary widely by region due to factors like clinic availability, local economy, and cost of living. Urban areas with numerous veterinary specialists might have higher premiums compared to rural locations. Checking local vet costs or consulting insurance comparison tools can help you account for this variability.

Deductibles, Reimbursement Levels, and Coverage Limits

The three pillars that determine your monthly premium and out-of-pocket expenses are:

-

Deductibles: The fixed amount you pay before insurance kicks in. Higher deductibles (e.g., $500) usually lower your monthly rates but mean more upfront costs when you file a claim. For example, opting for a $1,000 deductible could dramatically reduce premiums for young, healthy pets but increases financial risk if incidents occur.

-

Reimbursement Levels: The percentage of vet bills your insurer reimburses — typically ranging from 70% to 90%. A higher reimbursement level costs more but reduces your share of expenses when your pet needs care.

-

Coverage Limits: Policies often have annual or lifetime maximum payout limits. Some insurers like Pets Best and AffordablePet™ Insurance offer unlimited payout plans, ensuring no cap on reimbursements but often at a higher price. Plans with lower coverage caps can be more affordable but might limit the extent of insured care.

Balancing these variables according to your financial comfort zone and your pet’s health risks is key to finding optimal affordable pet insurance.

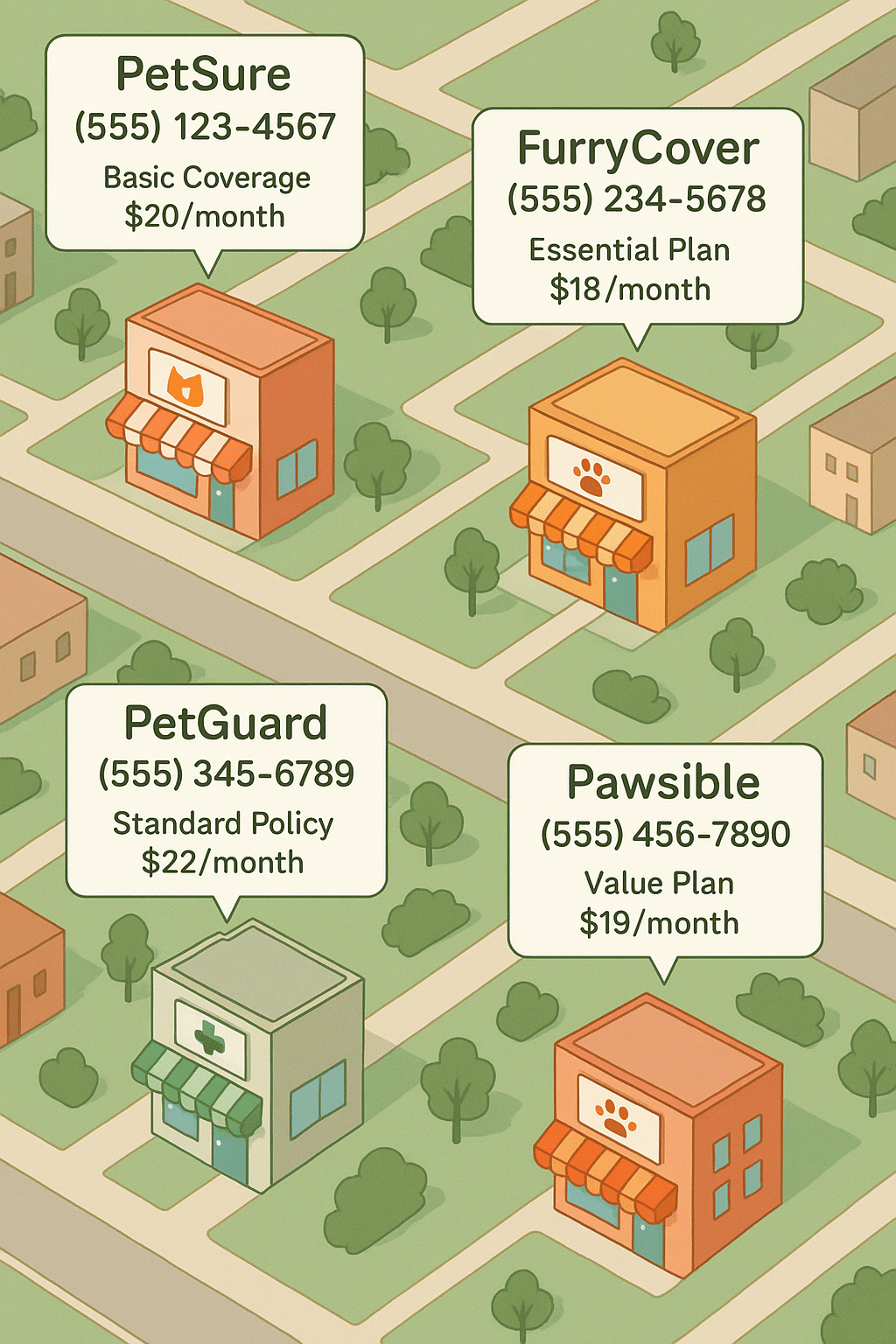

Comparing Top Affordable Pet Insurance Providers

Navigating the pet insurance marketplace can be overwhelming. Here’s an expert breakdown of seven reputable providers that offer a mix of affordability, comprehensive coverage, and customer-oriented features:

Pets Best Pet Insurance: Flexible Plans and Routine Care Options

Pets Best is lauded for its customizable plans, offering coverage from accident-only to full illness and routine care packages. With up to 90% reimbursement and no annual or lifetime payout limits, it’s ideal for those wanting comprehensive protection. Their easy digital claim submission and 24/7 pet helpline provide added convenience and peace of mind. (petsbest.com)

Spot Pet Insurance: Wide Vet Access and AAA Member Discounts

Spot allows access to any licensed vet across the U.S. and Canada, rewarding policyholders with up to 90% cash back on eligible vet bills. AAA members enjoy up to a 20% discount plus a $25 Amazon gift card—great perks for members. A 24/7 pet telehealth helpline and a user-friendly mobile app make Spot a solid affordable choice. (spotpet.com)

Embrace Pet Insurance: Wellness Rewards and Customized Coverage

Embrace stands out with its Wellness Rewards program that reimburses routine care costs like grooming, training, and vaccinations. Their thorough accident and illness coverage includes dental and alternative therapies, offering broad support for pet health. The Embrace mobile app lets you manage claims and coverage seamlessly. (embracepetinsurance.com)

Figo Pet Insurance: Pet Cloud App and Curable Pre-Existing Conditions

Figo combines flexible plans with excellent customer support and a cutting-edge Pet Cloud app. This app speeds up claims processing—processing most in under three business days—and provides 24/7 live vet access. Figo’s willingness to cover curable pre-existing conditions after a symptom-free period adds value for older pets or rescues. (figopetinsurance.com)

Chewy Pet Insurance: CarePlus Wellness Plans and Telehealth Services

Chewy’s CarePlus program offers tiered plans from accident-only to premium coverage that includes behavior therapy and prescriptions. The wellness plans combined with telehealth options like “Connect with a Vet” create a comprehensive package tailored for budget-conscious pet owners. Partnership with Trupanion enables direct payments to vets, reducing upfront costs. (chewy.com/pet-insurance)

Prudent Pet Insurance: Fast Claims and No Age or Breed Restrictions

Prudent Pet is notable for its speedy claims processing—over 75% are resolved within 24 hours—and comprehensive coverage without breed or age exclusions. Their plans come with additional benefits like unlimited 24/7 vet chat and vet exam fee coverage. Customer reviews highlight the company’s transparency and user-friendly experience. (prudentpet.com)

AffordablePet™ Insurance: Veterinarian-Founded Plans with Fast Claims Processing

Backed by veterinarians, AffordablePet™ Insurance offers flexible plans with unlimited annual benefits, routine care coverage, and fast online claims with direct deposit options. Their 24/7 pet helpline and personalized customer service enhance trust in their affordable yet comprehensive approach. (affordablepetinsurance.info)

7 Smart Ways to Save on Affordable Pet Insurance

1. Enroll Your Pet When They’re Young and Healthy

Sign up your pet early—ideally as a puppy or kitten—to secure the lowest rates and avoid pre-existing condition exclusions. Early enrollment allows you to build coverage before costly health issues arise.

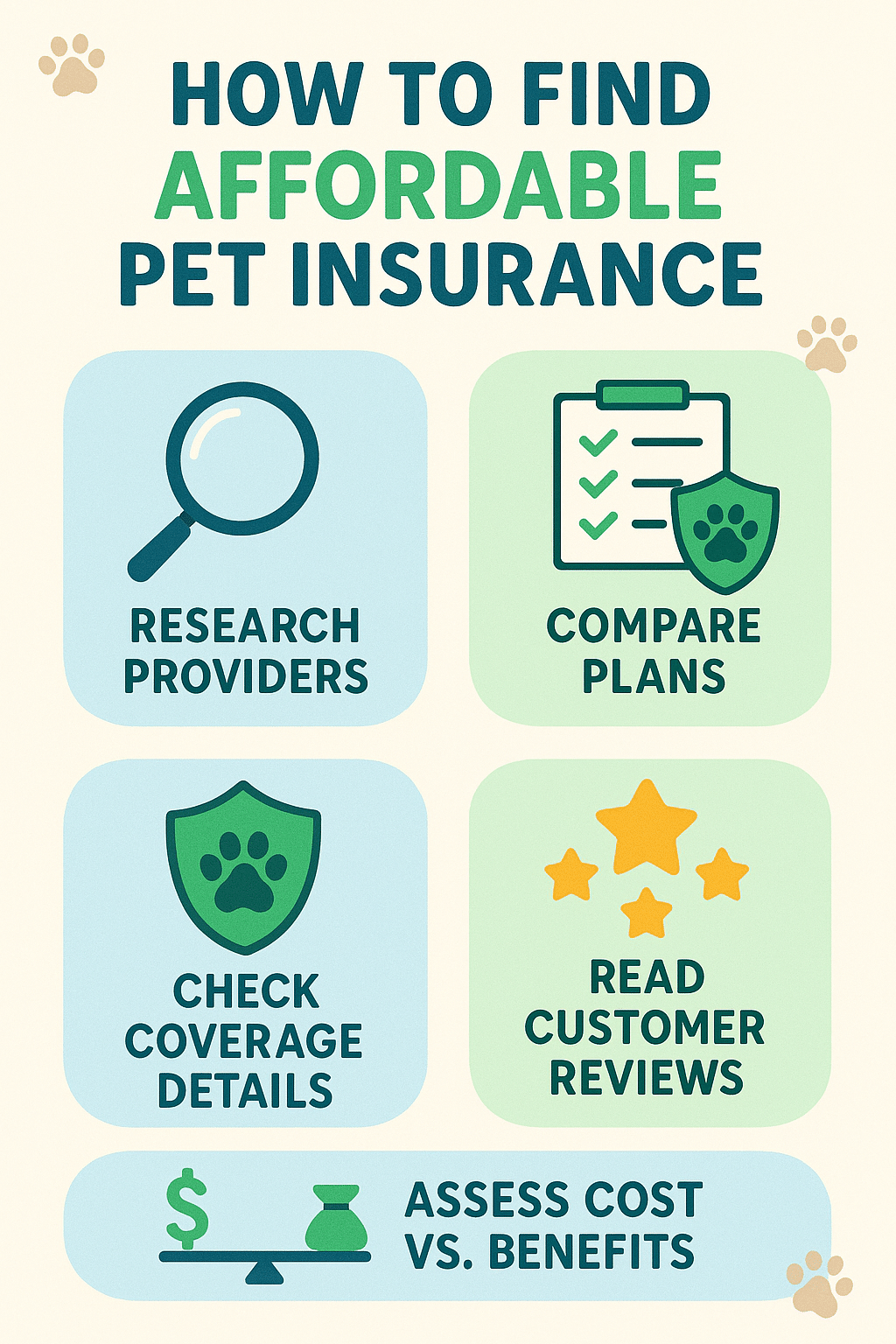

2. Utilize Affordable Pet Insurance Comparison Tools

Make use of reputable online comparison tools that incorporate the latest rates, policy features, and discounts for your region and pet’s breed and age. This research uncovers the best affordable plans tailored to your needs.

3. Opt for Higher Deductibles to Lower Premiums

Choosing a higher deductible reduces your monthly premiums. If you can manage larger upfront costs during claims, this is a powerful way to save on premiums.

4. Take Advantage of Multi-Pet Discounts and Bundling Options

Insurers like Spot and Figo offer discounts if you insure multiple pets together. Bundling saves money and simplifies managing your policies.

5. Explore Plans With Routine and Preventive Care Coverage

While these add-ons may increase premiums slightly, they help manage ongoing expenses like vaccinations and dental cleanings, preventing costly illnesses later.

6. Use Plans Offering Fast, Digital Claims Processing

Companies like Prudent Pet and Figo streamline claims with mobile apps, reducing the hassle and speeding reimbursements so you’re not out of pocket long.

7. Leverage Local Resources Like Low-Cost Vet Clinics and Community Programs

Pair your pet insurance with local low-cost clinics, such as Columbus Humane’s Essential Care Center, or community programs for spaying/neutering and vaccinations. This reduces out-of-pocket costs that insurance might not cover. (columbushumane.org)

How to Customize Affordable Pet Insurance Plans to Fit Your Needs

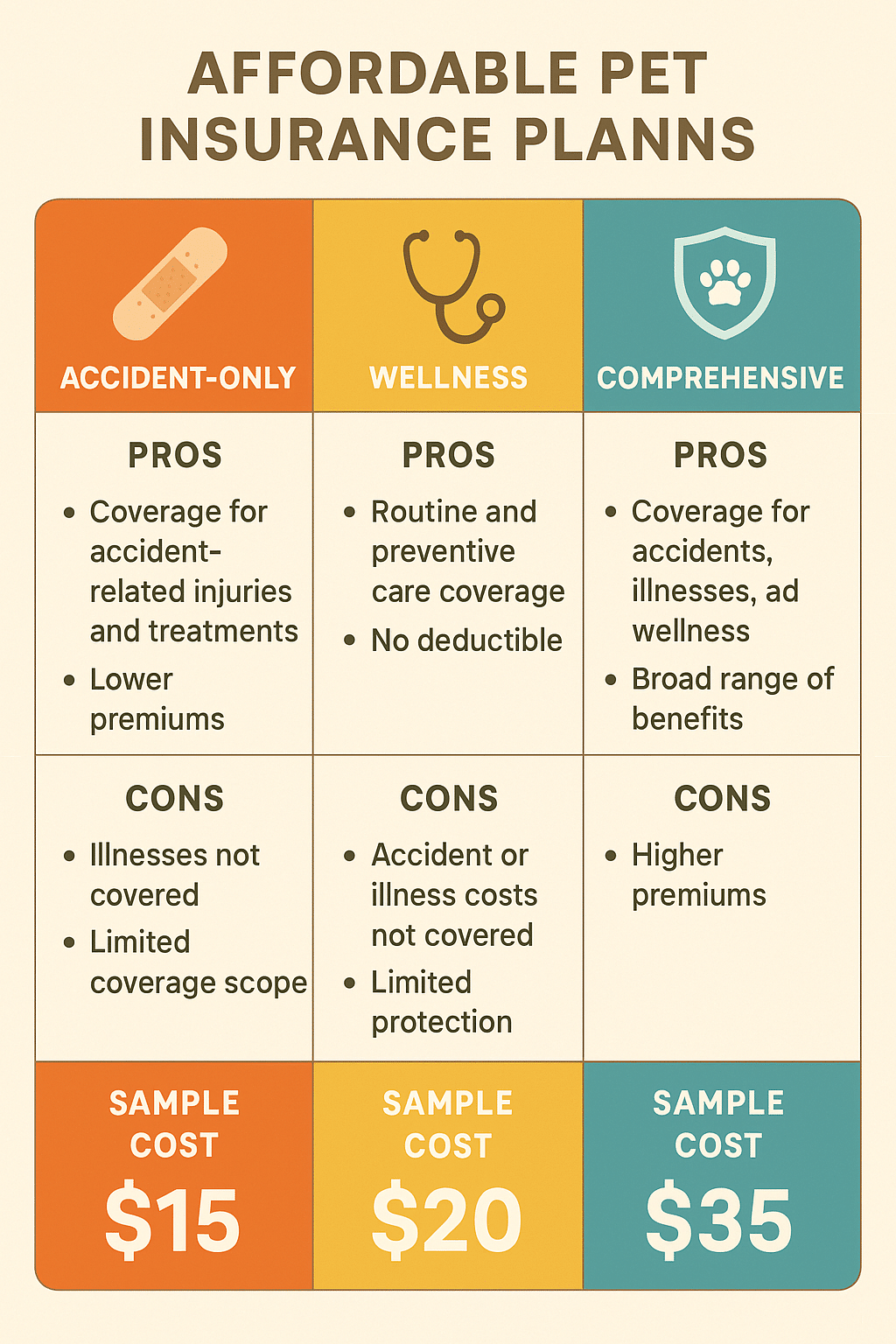

Choosing Between Accident-Only, Illness, and Wellness Plans

Flexible insurers allow you to pick between:

- Accident-Only Plans: Budget-friendly coverage focusing on injuries from accidents. Pets Best offers this option for cost-conscious owners.

- Illness and Accident Plans: Cover a wide range of health issues and sudden injuries, providing solid protection.

- Wellness Plans: Add-on options covering routine care like flea prevention, dental care, and vaccinations, reducing unexpected vet bills.

Assess your pet’s lifestyle, breed risk factors, and your financial tolerance to decide the right balance.

Adding Routine Care and Exam Fee Coverage for Budget-Friendly Care

Exam fee coverage helps with veterinary consultation costs that can add up with recurring visits. Prudent Pet and AffordablePet™ Insurance offer optional exam fee add-ons, helping budget monthly costs and provide more predictable expenses.

Understanding the Claims Process for Affordable Pet Insurance

Digital Tools and Mobile Apps to Streamline Claims

Leading providers like Pets Best, Figo (with their Pet Cloud app), and Embrace empower pet owners to submit, track, and manage claims digitally, cutting down paperwork and wait times significantly. These apps often have features like claim status notifications and direct deposit options, enhancing convenience.

Tips for Faster Reimbursement and Avoiding Common Pitfalls

- Maintain organized vet records and receipts.

- Submit claims promptly online.

- Understand policy terms fully to avoid denied claims.

- Double-check coverage details before procedures.

- Communicate with customer support to clarify claim questions.

Following these tips helps ensure a smooth claims experience and quick payouts.

The Role of Affordability in Pet Health and Longevity

How Insurance Encourages Timely Veterinary Care

Affordable pet insurance removes financial hesitation, encouraging owners to seek timely diagnostics and treatments that extend pets’ lives and improve quality of life. Early detection, covered by insurance, can prevent expensive emergency situations down the road.

Insights on Preventing Financial Burdens and Stress for Pet Owners

Unexpected veterinary bills are a major source of stress for owners — pet insurance helps avoid financial shocks, allowing you to focus on your pet’s recovery without worrying about credit card debts or delayed treatment.

Local and Community Support for Affordable Pet Care

Utilizing Low-Cost Vet Clinics Like Columbus Humane’s Essential Care Center

Local clinics focused on affordable and accessible care provide vaccinations, microchipping, and spay/neuter services at reduced costs. Combining these resources with insurance amplifies savings and ensures your pet’s continuous care. (columbushumane.org)

Finding Pet-Friendly Services and Discounts in Your Community

Many communities offer pet-friendly parks, grooming discounts, training classes, and rescue organizations that sometimes collaborate with insurers to offer exclusive offers or assistance. Check local listings to maximize benefits.

Final Checklist: What Pet Owners Should Consider When Choosing Affordable Pet Insurance

Evaluating Customer Service and Support Availability

Prompt, helpful customer service can make a huge difference during stressful times. Providers like Prudent Pet and AffordablePet™ Insurance emphasize personalized support available via chat, phone, or text.

Considering Plan Flexibility, Coverage Options, and Cost Transparency

Look for insurers that allow you to tailor plans, understand all fees upfront, and clearly explain what’s covered. Transparent contracts prevent surprises.

Reviewing Reviews and Feedback from Other Pet Owners

Reading customer reviews on sites like Trustpilot or the Better Business Bureau gives real-life insights into claim experiences and satisfaction levels.

FAQs

1. What is the best affordable pet insurance plan for dogs?

Providers like Pets Best and Prudent Pet offer flexible, comprehensive plans with no breed restrictions and fast claims processing, making them excellent affordable options for dogs.

2. Can I get affordable pet insurance for senior cats?

Yes, companies like Prudent Pet and Figo provide coverage with no upper age limits, catering well to senior cats while maintaining affordable premiums.

3. Are there cheap pet insurance plans with wellness coverage?

Chewy’s CarePlus wellness plans and Embrace’s Wellness Rewards are budget-friendly options that reimburse routine and preventive care to keep overall costs manageable.

4. How do deductibles and reimbursement levels affect pet insurance costs?

Higher deductibles generally lower monthly premiums, while higher reimbursement levels increase premiums but reduce out-of-pocket expenses when filing claims.

5. Is it better to buy pet insurance when pets are young or older?

Buying insurance when pets are young locks in lower rates and avoids pre-existing condition exclusions, saving money long-term.

Quick Takeaways

- Affordable pet insurance balances cost with comprehensive coverage and flexibility.

- Age, breed, location, deductible, and reimbursement percentages heavily influence premiums.

- Leading providers include Pets Best, Spot, Embrace, Figo, Chewy, Prudent Pet, and AffordablePet™ Insurance.

- Smart savings strategies include early enrollment, using comparison tools, and choosing higher deductibles.

- Digital claims apps streamline the reimbursement process.

- Pet insurance promotes timely care, preventing costly emergencies and financial stress.

- Leveraging local low-cost clinics and community programs maximizes affordable care.

Conclusion

Finding affordable pet insurance that truly supports your furry family members doesn’t have to be a puzzler. By understanding what to look for—such as coverage details, cost-driving factors, and reliable providers—you position yourself to secure a policy that keeps your pet healthy and your wallet happy. Remember, enrolling your pet when they’re young and healthy, comparing plans carefully, and tapping into discounts and local resources are all savvy moves that pay off in the long run.

Through companies like Pets Best, Figo, and AffordablePet™ Insurance, you’re not just purchasing a policy—you’re investing in peace of mind, steadfast care, and a healthier, happier life for your pet. Ready to give your pet the coverage they deserve? Take time to explore these plans, get personalized quotes, and join the thousands of pet owners enjoying worry-free veterinary care. Your pet’s health is priceless—let affordable pet insurance help you protect it.